PROMAK TS

direct access to the Warsaw Stock Exchange

Take advantage of an advanced solution to support the trading of financial instruments on the regulated capital market. Provide traders with support in handling client activity. Check out what else you gain with PROMAK TS.

Explore the

possibilities of

PROMAK TS

PROMAK TS is a high-performance, fast and reliable solution that guarantees real-time market access. The system ensures:

System abilities

PROMAK TS

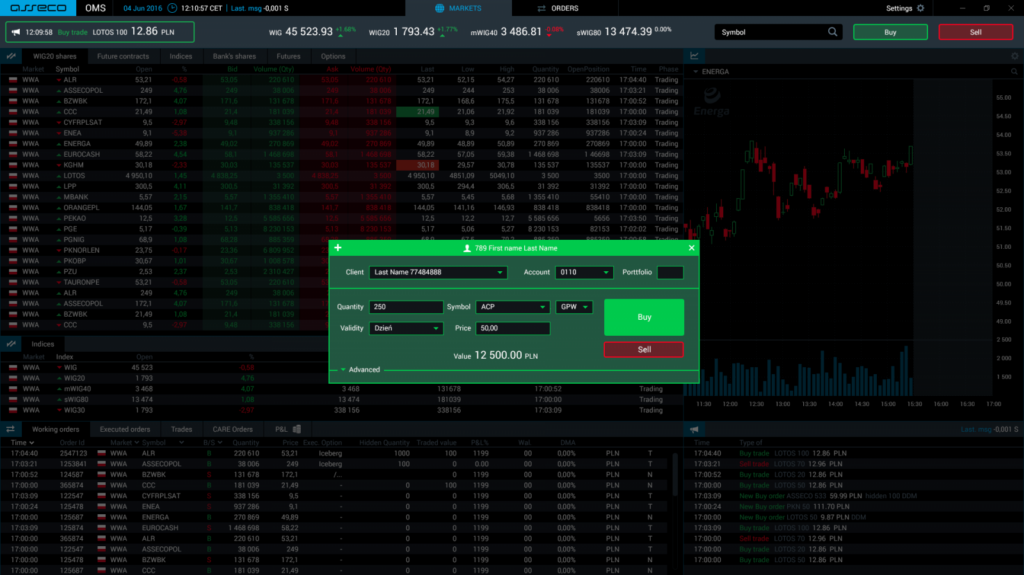

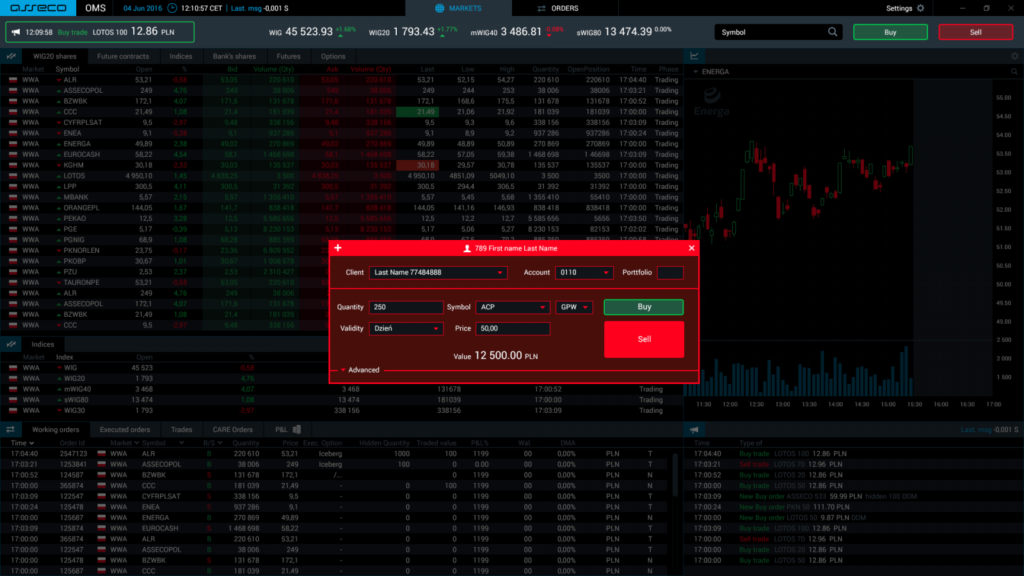

an advanced solution for traders

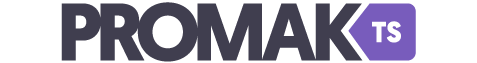

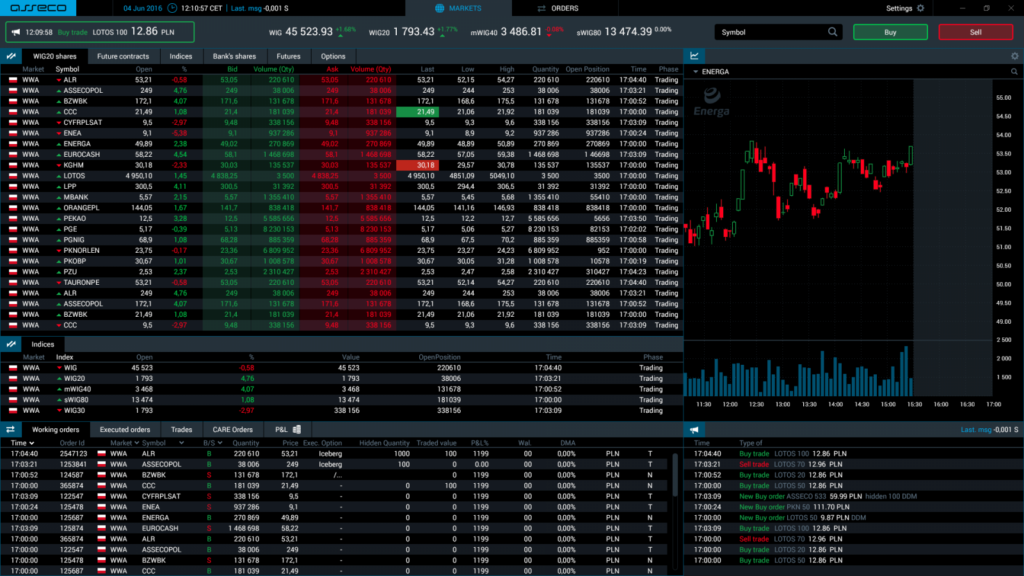

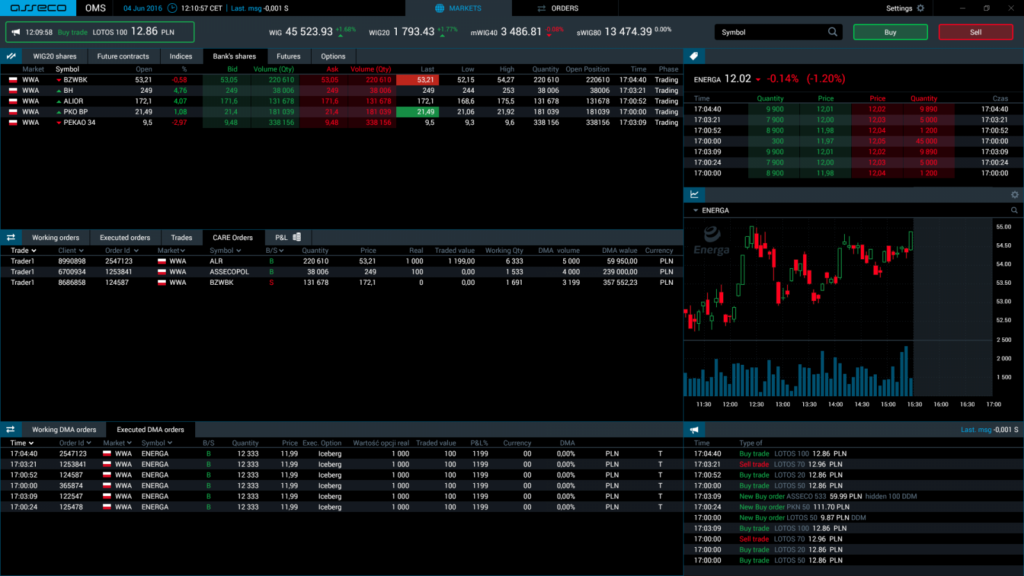

PROMAK TS is a platform that facilitates controlling the status of investments and make informed business decisions. It has a user interface that complies with current standards and is optimized for traders’ requirements. Learn about the features of PROMAK TS.

Observation of the regulated capital market

Execution of CARE/DESK orders

Monitoring of orders and transactions

Investment risk management

FIX connector (Financial Information eXchange)

Allocations & Aggregations

What’s your next step?

Send us a message.

You will be the first to receive the latest information on the development of PROMAK systems.